report pages 107-113

Section 20 - Information and education – who should do that and how?

Section 15 (households’ financial position) and what we have discovered from the Survey of Family Income and Employment (SoFIE) indicate that New Zealanders as a whole seem to have made relatively ‘sensible’ decisions about retirement saving. That happened, at least until 2006 (before KiwiSaver started), despite the absence of quality, accessible and relevant information at a household level.

The recommendations of section 15 should result in a new longitudinal survey, one designed specifically to follow households’ financial lives[1]and that will become a rich source of data[2]. Making that data accessible to savers through an educational programme is a legitimate role for governments, as suggested in section 11 (Role of the government).

We have very little credible information on what individuals know about their personal financial situations, what their retirement aspirations might be and what, if anything, they are doing about those. Surveys on what groups of people think about these issues are pointless and no more helpful than asking those same groups whether they should exercise more or eat less[3]. Vox pop interviews are even less useful. What they do is much more interesting than what they think.

Equally, we have little credible current information on employers’ attitudes to their employees’ information needs, whether employers might be prepared to help plug those information gaps and whether they are presently doing anything about these things.

In a 2003 survey of the largest 100 employers in New Zealand for the 2003 Periodic Report Group (and also a sample survey of employees working for some of those employers)[4]:

“About 40% of all our employers pay their employees under a “total remuneration” approach. About 80% of the employers (by employee numbers) have a superannuation plan that is open to at least some employees. That is probably more than would be the case for all New Zealand employers.

About half of all employers have a payroll deduction facility that lets employees authorise contributions to be taken out of pay on an unsubsidised basis…

Employers generally thought that they had a role to help employees (scored 3.47 [out of 5]) and the most popular specific option was to provide employees with “information and education” (scored 3.71). Interestingly, employees do not currently see their employers as a source of advice on retirement issues (only 8% recognised employers in this way in a prompted question). Employers became progressively less enthusiastic at their potential involvement as the cost of their potential role increased with subsidies to saving and insurance benefits.”

The Retirement Commissioner’s 2016 Review noted an unsourced 2015 survey of Employers and Manufacturers Association members “…that found 28% of senior managers had total remuneration packages and 20% of all other staff”[5].

US reports suggest that financial literacy is a prerequisite for a successful retirement planning information programme. Those with lower levels of financial literacy seem not to plan for retirement as much/well as those with higher levels. That is not very surprising. What it means though is that financial literacy must come first otherwise planning help is probably wasted[6]. However, what can be done about financial literacy seems at variance with some of New Zealand’s own initiatives.

Two reports from the United States suggest that the cost of financial education through secondary schools is wasted[7]because there is seemingly virtually no correlation between financial education and financial behaviour.

We cannot expect individuals to make ‘sensible’ decisions about their own long-term financial planning unless they know some seemingly quite basic knowledge about the financial environment. That is probably a task beyond a government’s capacity to do much about on its own. Instead, the government should engage with employers and financial institutions on the basic precepts underpinning financial literacy as those institutions have an economic stake in their employees’ and customers’ understanding of some key details.

However, starting that project after citizens become employees and major consumers of financial services may be too late to see real change without some committed hand-holding. Financial concepts and explanations of how markets work and relate to ordinary citizens’ lives should be embedded in all aspects of the schools’ curriculums at all levels. It goes right back to fundamental issues like the ability to manipulate numbers; to test numerical results for ‘sense’; to ask the appropriate ‘what if?’ questions. We strongly believe that encouraging mathematical competenceshould be at the heart of every aspect of school curriculums. Mathematical competence is central to making financial decisions about retirement and also to nearly every other part of our lives.

Starting that programme with the teachers themselves might be a good beginning. The international evidence on financial literacy standards amongst 15-year old secondary school pupils is not encouraging – the OECD’s PISA comparative study in 2012 tested pupils’ levels of ‘financial sophistication’. The pupils’ results “mimic those from the adult population”. Boys seemed to perform better than girls and “a sizeable part of the variation in financial literacy is explained by student socio-economic backgrounds. In other words, inequality in financial literacy is already apparent in high school, and these differences appear to increase later in life.”[8]

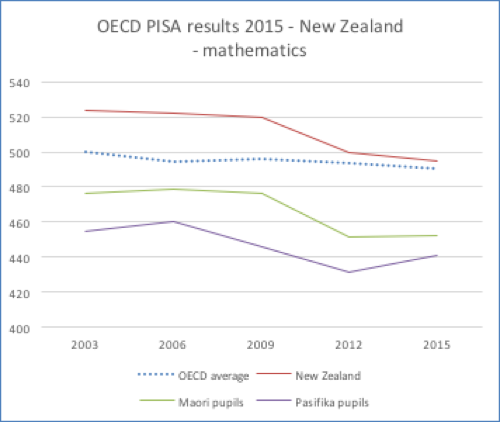

The OECD’s 2017 report on New Zealand’s economic outlook[9]pointed out falling average PISA scores but, in particular, falling mathematics scores as a specific potential brake on future growth. The chart on the next page shows what has happened in the last 15 years. Of real concern should be the relatively poor performance of Maori and Pasifika pupils.

New Zealand was 16th of 35 OECD countries in mathematics – as discrete groups Maori and Pasifika pupils would have been 33rd and 34th respectively. The OECD emphasises the need to improve this aspect of our education programme:

“To lift outcomes in the long term, a systemic approach is necessary to improve the effectiveness of mathematics teaching in primary and intermediate schools. Key elements of such an approach include: raising initial teacher education quality and entry standards (current minimum entry standards for teaching programmes are relatively low); supporting professional learning and development that lifts the capability of the current workforce to teach mathematics; and supporting school leavers to lead a collaborative, data- and evidence-informed teaching culture that emphasises all aspects of the mathematics curriculum.” (at page 55)

We agree with the OECD.

For retirement planning generally, in our experience, building a network of trusted mentors would also help. The ordinary citizen is overwhelmed by data and complexity and needs ‘hand-holding’ help to cut through to relevant information. Most do not need a fee-based ‘financial planner’; employers can also help here.

We know that citizens generally have low levels of financial literacy. That certainly seems to be the case in the US for the population as a whole[10]and for older people in particular[11]. Because of this, savers make mistakes that can be expensive, not just about saving and investment decisions but also about debt, state pension benefits (particularly in the US, where there are choices about Social Security pension starting dates) and insurance arrangements.

The US report Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education Programs[12]summarised the position in one of the most sophisticated financial markets:

“The complexity of choices is enormous, and many people are unable to make informed decisions without the help of professional financial advisers[13]. Financial decisions are very personal, and a majority of people want to speak one-on-one with a trusted professional about their own individual situations ... Most workers have not sought advice from online tools or general seminars. But just who are these professionals? What are the standards? How do they make money? What are their incentives? How do we protect clients from bad advice? What actually is good advice? Does advice alone effect changes in personal habits?”

The answer to these questions, according to this report, is a bit dispiriting. Most of those who agree they need help, if asked, seem to think that advisers are unaffordable, conflicted and offer an “unclear value proposition”. But the reality is that most retirees have few financial assets.

The US seems afflicted by multiple agencies that supervise varying fiduciary requirements. A uniform set of standards seems essential.

However, it seems the only way forward is better education and so better-informed employees.

“Accordingly, there is little choice but to mesh advice with more informed participants in the workplace.”

We agree with the suggested emphasis on information and education but think there needs to be a clear view on just who can add value in which areas. We think that the government should, however, resist the temptation to regulate[14]. As we have demonstrated in sections 9 (On tax subsidies for saving) and 10 (On compulsory saving for retirement) governments are relatively powerless to direct its citizens to save more or save more in this way rather than that. We also think that the latest requirements for KiwiSaver schemes around fees and expected retirement income will not achieve the desired outcome of better decision-making.

The first priority for the government is the gathering and dispersal of high-quality data – only governments have the capacity to enforce disclosure of that information. As already discussed, there is a lot of work to do in New Zealand on this topic. Little can happen effectively at the next step without that high-quality data.

Next, only the government can provide regulatory oversight and enforce appropriate levels of disclosure. The government itself could participate by publishing comparative data, particularly investment performance comparisons.

To the extent the government has a role in establishing school curriculums, we agree that general literacy comprehension, numeracy and financial literacy can provide the necessary tools to gain, eventual financial competence. However, we think that governments should stay away from forcing, incentivising or even ‘nudging’ citizens of older ages to behave in particular ways, such as through ‘default’ settings in KiwiSaver.

On the other hand, employers may have different motives for persuading or even forcing employees to save for retirement. We think that may be appropriate, but employers need to be clear about their objectives in promoting a particular form of behaviour.

In the meantime, citizens still need help with important issues that have nothing directly to do with their retirement savings. Gaining appropriate ‘retirement job’ skills would be one of those; choosing the age from which to ‘retire’ is another, understanding housing-related options yet a third.

Part of the government’s regulatory responsibilities with respect to collective saving vehicles (such as KiwiSaver) is to ensure disclosure and reporting requirements are consistent across similar products (see section 18 – Disclosure – both initial and ongoing). That consistency can then extend to the collection and publication of statistics on fees and investment performance and those themselves will form the basis of an information programme directed at savers.

New Zealand’s Commission for Financial Capability (CFFC) has focussed much of its recent activity on attempting to improve New Zealanders’ ‘financial capability’:

“Financial capability goes deeper than what we know about money. It’s feeling confident to make wise judgements about how we use and manage our money in ways that benefit us now and in the future, enable us to reach our goals, provide for our family and, ultimately reach retirement in good financial shape.”

“AT CFFC, we understand this and use it to inform our work. By unravelling what motivates people, our financial capability programmes create lasting behaviour change. Improving New Zealanders’ ability to manage their money across a lifetime gives individuals greater financial certainty and freedom. It helps to reduce hardship among families, creates resilient communities and a more prosperous and productive economy. We recognise financial capability as an essential life skill for all New Zealanders.” From the Commission’s website here.

In 2015, the CFFC published a National Strategy for Financial Capability (accessible here):

“The vision outlined in this National Strategy is to equip everyone to ‘get ahead financially’… The term ‘getting ahead’ holds different meanings for different people, but at its core it is about how we successfully navigate our way through products, choices, demands and needs across a lifetime.”

One of the strategy’s objectives is to join the financial services industry up with the government, the education sector, NGOs, the Stock Exchange, workplaces, Maori groups, the media and the CFFC itself.

The last government supported this initiative:

“The Minister of Commerce and Consumer Affairs, Paul Goldsmith has issued a government statement to reinforce the contribution financial capability makes to the goal of everyone getting ahead financially.

‘Building the financial capability of New Zealanders is a priority for the Government. It will help us improve the wellbeing of our families and communities, reduce hardship, increase investment, and grow the economy.’

Government agencies will be working more collaboratively, including financial capability outcomes as a consideration in service delivery and will be looking to increase the work with industry and the community for better results. The government statement recognises that building financial capability is a shared responsibility and that everyone has a part to play. It also recognises that financial capability is built at home, at school, in workplaces and elsewhere in the community.”[15]

In the government’s response to the Retirement Commissioner’s 2016Review, the Minister of Commerce and Consumer Affairs also stated:

“Raising New Zealanders’ level of financial capability is a Government priority. The Government is committed to supporting the Commission for Financial Capability and the Ministry of Social Development and encouraging other organisations to provide financial capability programmes that reach New Zealanders of all ages.”[16]

This all looks reasonably sound with admirable objectives, but we would like to see evidence of what is actually being achieved.

An Annual Report 2012 - National Strategy for Financial Literacy (accessible here) seems to be the first and only such report since New Zealand’s ‘National Strategy for Financial Literacy’ was launched in 2008. There were passing references to “raising financial capability” in the formal report of the Retirement Commissioner’s 2016 Review (accessible here) but seemingly no recent, substantial data that establish whether the National Strategy has changed the way New Zealanders as a whole do things.

The Sorted web site

One of the Commission for Financial Capabilities (CFFC’s) major initiatives since it started more than 20 years ago has been the web site at www.Sorted.org.nz. It offers a number of calculating tools that are used online; also, guides on issues like planning, budgeting, managing debt, home buying, ‘protecting’ wealth, KiwiSaver and investing.\

The 2016 Review(accessible here) made no reference to Sorted(other than a passing reference to a calculation done using a Sorted calculator). The 2013 Review of Retirement Income Policies [17]made a total of nine references to Sorted but those were confined to what Sorted does and not whether it works or whether it might be improved.

The calculators take what we think is an unnecessarily simple view of a user’s financial life. The retirement saving calculator, for us, requires too much information before any useful material starts emerging. It also takes account of only some issues.

We support the idea of Sorted but suggest that New Zealand needs to understand whether the costs of keeping the web site up to date can be justified. We think that such a review should have been part of both the 2013 and 2016 Reviews.

Terms of reference for 2019 Review

We were surprised that the Terms of Reference for the Retirement Commissioner’s 2019 Review asked for no information or assessment of the work done to date by the CFCC on financial literacy or the financial competence of New Zealanders, given that most of the CFFC’s public profile focusses on these initiatives. The only, potentially passing reference might be in paragraph 1 that asks for:

“An assessment of the effectiveness of current retirement policies for financially vulnerable and low-income groups, and recommendations for any policies that could improve their retirementoutcomes.”

The 2019 Review will be deficient if it does not look at this important issue. Here are the questions that it should address.

Questions New Zealand needs to discuss on information and education:

What is the employer’s role in helping employees to understand what to do about retirement saving and other financial preparation for retirement (reducing debt, re-training, new skills etc.)?

What is the education system’s role in improving mathematical competence and financial literacy? We should start with teachers themselves as a discrete project.

What has happened to the ‘National Strategy for Financial Literacy? Where is the evidence that it is achieving the objectives established in 2008? Why haven’t more ‘annual’ reports been published?

Why isn’t the government collecting returns, expense and other data on collective saving vehicles, including KiwiSaver, and having that analysed by an independent body and publishing the results on a regular (say, quarterly) basis?

Does the CFFC’s web site Sorted work? How much does it cost? How successful is it?

Can the government make available a more useful on-line tool that would allow ordinary New Zealanders to make reasonable decisions about their retirement saving and other financial planning issues in the context of their household’s assets and liabilities?

[1]Running a longitudinal survey is expensive and there is a natural temptation to add different modules to reduce costs per survey. Though that may be tempting, we think it should be avoided in the case of a household financial survey. It did not work for SoFIE.

[2]In a different field, the Dunedin Multi-Disciplinary Health and Development Study (see here) has produced outstanding results on a whole range of health and social issues. It started almost informally with a study of 1,000 children born in 1972-3 in Dunedin and has become a world-recognised source of data. We envisage similar possibilities for a proper study of New Zealand households’ financial lives.

[3]A recent example of an industry-led, self-serving survey is Shaping Futures – Closing the KiwiSaver Gap, Financial Services Council, 2019 accessible here. It recommended higher contributions, a “forward-thinking superannuation strategy”, more “choice of the type of fund” and further tax breaks and better information about expected future balances. All this is based on asking 2,199 New Zealanders what they think about KiwiSaver.

[4]Tier 2 Retirement Savings: Employers’ and Employees’ Attitudes and Practices, 2003 ESR Consortium accessible here. We were two of the three authors of that report.

[5]2016 Review accessible here at page 17. No source for this was directly quoted in the report so we do not know how the profile of employers compares with the 2003 largest 100 employers already quoted.

[6]Financial Literacy and Retirement Planning: New Evidence from the Rand American Life, Olivia Mitchell (2007) accessible here.

[7]See (1)High School Curriculum and Financial Outcomes- The Impact of Mandated Personal Finance and Mathematics Courses, Pouslon, Shastry and Cole (2014) accessible here; (2) Financial Literacy, Financial Education and Downstream Financial Behaviors, Fernandes, Lynch and Netemeyer (2013) accessible here.

[8]Financial Literacy and Economic Outcomes, Olivia Mitchell and Annamaria Lusardi (2015), accessible here.

[9]OECD Economic Surveys – New Zealand(2017) accessible here at page 52.

[10]Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education Programs, Annamaria Lusardi and Olivia Mitchell, (2007), Pension Research Council – accessible here.

[11]Financial Literacy and Financial Sophistication in the Older Population: Evidence from the 2008 HRS, Annamaria Lusardi, Olivia Mitchell and Vilsa Curto (2009), Michigan Retirement Research Center – accessible here.

[12]Annamaria Lusardi and Olivia Mitchell; published in 2012 by the Pension Research Council and accessible here.

[13]Part of the problem in the US (and many countries) is the numbing complexity of tax and regulatory requirements. At one time in the US, there were literally 57 different ways that retirement savings could be affected by tax considerations. The position is better, but still complex, in New Zealand – see section 17 (Income tax and saving vehicles) for a description of the different tax treatments of different saving vehicles.

[14]For example, we think it is pointless to make investor education a condition of default KiwiSaver provider appointments. When announcing the 2014 appointments, the Minister said: “As a requirement of their appointment, the KiwiSaver default providers will also offer investor education to encourage people to make this active choice [from the default investment option to something more ‘suitable]. This reflects the Government’s commitment to build on KiwiSaver’s contribution to developing a savings culture and lifting New Zealanders’ confidence in our financial sector…” Craig Foss, Minister of Commerce 28 March 2014 (accessible here). We think providers will ‘tick’ that particular box but it will make little measurable difference though it would be nice to find that out.

[15]At the time of our 2017 report The Missing 2016 Review, the press release was on the Commission’s website. It has been removed since.

[16]Letter to the Retirement Commissioner of 7 June 2017 accessible here.

[17]Focusing on the Future: Report to Government(2013) Commission for Financial Literacy and Retirement Income (as it was then known), accessible here.